pay ohio rita taxes online

Offer helpful instructions and related details about Ohio Income Tax Online Payment - make it easier for users to find business information than ever. Beside utility payment box 107 E Main Street Xenia Ohio 45385 Youngstown.

Norwalk City Income Tax - The April 15th income tax filing and payment deadline has been.

. Ohio Regional Income Tax Agency. Amounts under 1001 will not be collected or refunded. On this summary the estimated payments made are not showing up even though they are entered correctly and showing up on the Form 37.

Use the message center to send us a secure email. You can also view outstanding balances if any and update certain contact information ie. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online.

Payments by Electronic Check or CreditDebit Card. If you recently moved to Ohio you may have heard a neighbor lament about the RITA Tax But what is the RITA Tax. Individuals - Online Services MyAccount - Regional Income Tax Agency.

Allows you to viewprint transcripts of previously filed returns up to 10 years and Ohio 1099-G1099-INT forms up to 5 years. However we are accepting taxpayers by appointment only. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text.

Login to MyAccount 247 to make payments. Self-service phone options - making a payment checking refunds and estimates - available 247. 632 PM EDT March 30 2017.

03-29-2020 1007 AM. Mailing address telephone number andor email address with the Department. Routine System Maintenance Thursday May 26th.

Resident individuals of a RITA Municipality who are 18 years of age and older even if no tax is due. They provide a mechanism for taxpayers to file and pay online through FastFile. Individuals under 18 years of age are exempt from paying municipal income tax.

With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate. Tax Payment Mailing Address. An Ohio Regional Income Tax Return Form 37 must be filed by.

2761 Salt Springs. No login User ID or Password is necessary however you must be ready to complete your return or exemption in one session. RFP Invitation - Network Intrusion Prevention System Solution.

All other individual income tax returns and exemptions with the exception of Amended returns which must be filed By. Several options are available for paying your Ohio andor school district income tax. Who Has to File RITA Taxes in Ohio.

Our office is currently closed to the public for walk in traffic. RITA OFFERS A FULL RANGE OF ONLINE FILING AND PAYMENT OPTIONS FOR YOUR CONVENIENCE. Payments can be made over the phone with our 247 self-service options at 8008607482.

One Government Center Suite 2070. For Tax Year 2017 and prior 2106 Business Expenses are limited to the amount deductible for federal tax purposes. Plastic Molding For Countertops Top Plastic Surgeons Florida Top 25 Mechanical Contractors.

Nonresidents of a RITA Municipality who have earned income from a RITA municipality that is not subject to employer withholding or if the employer did not fully withhold for the. The city summary Im referring to is that location. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text.

Payments by Electronic Check or CreditDebit Card. Top Rated Rheumatologist In Ohio. State Local Taxes Ohio RITA Resident City Summary EF Only.

Individuals who are ready to file a municipal income tax return or an exemption in one online session can file using FastFile. You can reach the office by email or phone at 740-203-1225. Ohioans have the distinct privilege of paying a residence tax in addition to a work place state and federal tax.

Ohio City Main Menu. Also you have the ability to view payments made within the past 61 months. Taxpayers can pay with a credit card but will incur a 275 third party service fee.

THE CITY OF NORWALK WILL BEGIN UTILIZING THE REGIONAL INCOME TAX AGENCY RITA FOR FILING AND COLLECTION OF ITS INCOME TAX BEGINNING JANUARY 1 2017. Several options are available for paying your Ohio andor school district income tax. Exactly - thats the CD.

Income Tax Non Filing Letters From Rita Mailing This Week City Of Mentor Ohio

Ohio Regional Income Tax Return Rita Support

Euclid Voters Rejected Moving Income Tax Collection To Rita 11 Months Later City Council Approved New Contract With The Agency Cleveland Com

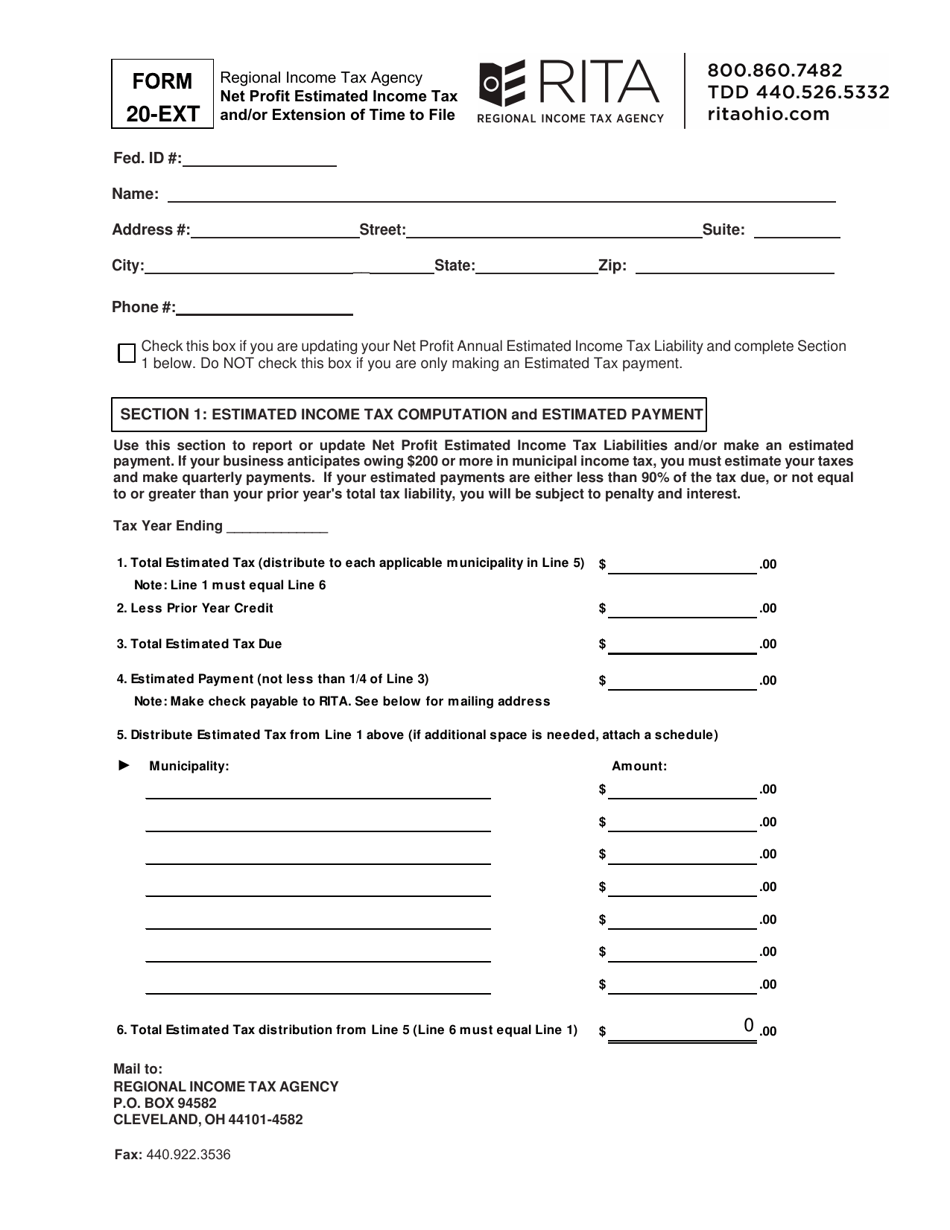

Form 20 Ext Download Fillable Pdf Or Fill Online Net Profit Estimated Income Tax And Or Extension Of Time To File Ohio Templateroller

Aspire Auctions 1231 A Black Lace Seq Vintage Fans Antique Fans Hand Held Fan

Tax Season Where To Send Local 2020 Tax Returns Euclid Digest

Free Lease Rental Agreement Forms Ez Landlord Forms Rental Agreement Templates Being A Landlord Lease Agreement

Many Americans Will Receive 1 200 Payments From The Irs And Many Have Questions About The Motley Fool Debt Money

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Tax Information City Of Fairview Park Ohio

City Income Tax Galion Oh Official Website

Lawsuit Ohio Illegally Double Taxes Residents Who Don T Know How Much Was Withheld By Their Employers Cleveland Com