food tax in massachusetts

The base state sales tax rate in Massachusetts is 625. As with cigarettes decreasing junk food consumption can reduce the burden of associated diseases.

Masstax Prepared Accounting Blog Accounting Insights Tips News

In the state of Massachusetts sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

. In May 2016 the Annual Town Meeting adopted Massachusetts General Law Chapter 64L section 2 a which established a local meals tax of 075 three-quarters of one percent. Massachusetts local sales tax on meals. The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

And junk food taxes have shown no negative impact. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Several examples of exceptions to this tax are.

These businesses include restaurants cafes. The Food Stamp Act of 1964 appropriated 75 million to 350000 individuals in 40 counties and three cities. The measure drew overwhelming support from House Democrats 90.

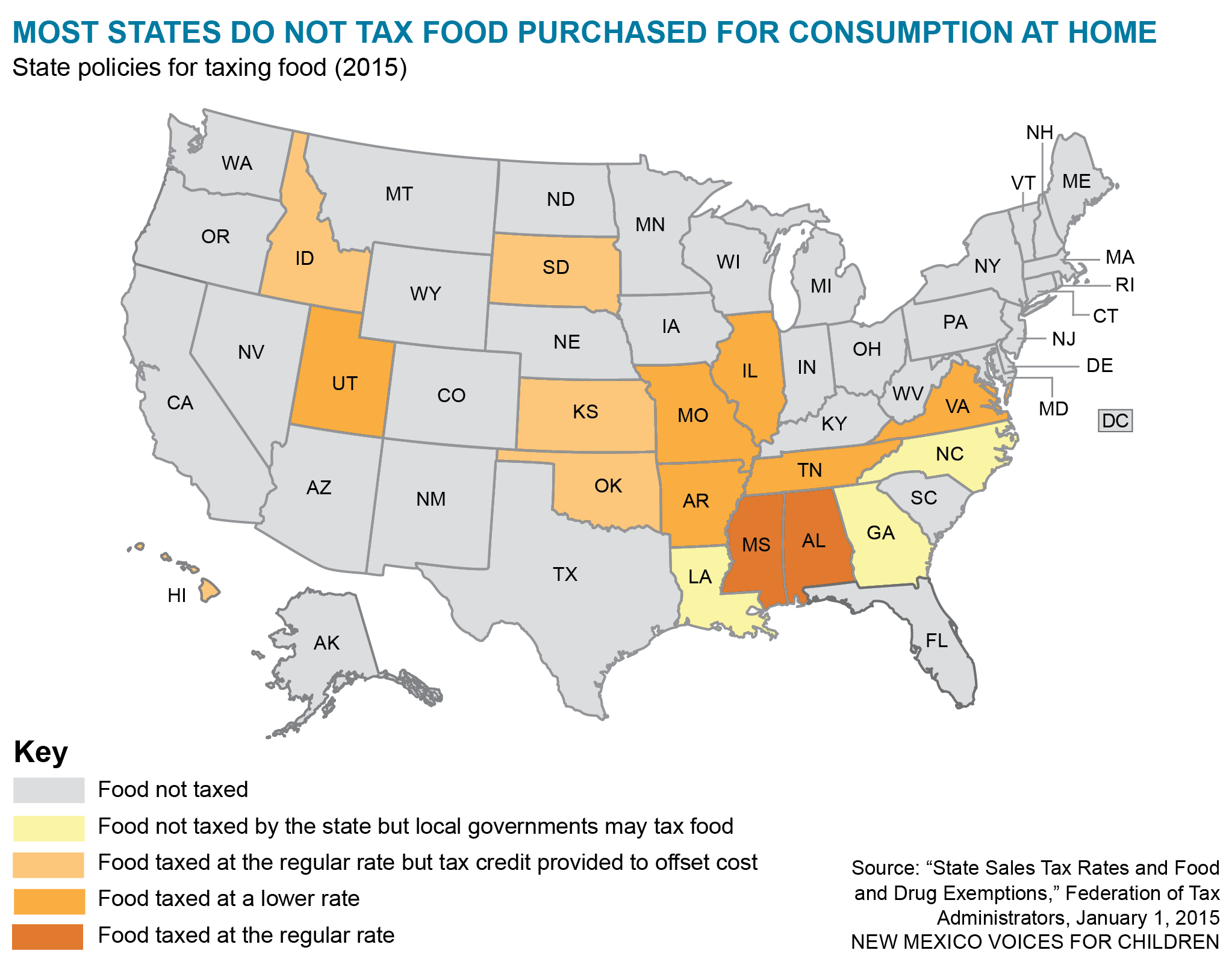

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The meals tax rate is.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Prepared Food is subject to special sales tax rates under. The meals tax rate is 625.

Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross income of less than 100000 were eligible for an 850 direct relief payment. This page describes the taxability of. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates. Generally food products people commonly think of as.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Generally food products people commonly think of as.

Harvard researchers estimate adding pennies to sugary drinks alone would raise 368 million annually in Massachusetts. Raising revenue from a junk food excise tax can create funds to reinvest. All winegrowers all farmer-brewers and all wholesalers of alcohol beverages licensed in Massachusetts must file Forms AB-1 AB-1F also known as Schedule F and AB 4.

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Catalyst Restaurant Menu In Cambridge Massachusetts Usa

Food Tax Repeal Think New Mexico

Massachusetts Announces Additional Tax Relief Measures For Businesses Framingham Source

Low Income Housing Tax Credit Impact In Massachusetts Mel King Institute

Europa Pastries Coffee Shop Menu In Fall River Massachusetts Usa

Form St Mab 4 Fillable Sales Tax On Meals Prepared Food And Or Alcoholic Beverages For The Months Of August 2009 And The Months Thereafter

A Health Impact Assessment Of A Food Tax In New Mexico New Mexico Voices For Children

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

Sales Tax Massachusetts Taxpayers Foundation

Massachusetts Estate Tax Doesn T Have To Be So Confusing Ladimer Law Office Pc

Sports Betting Tax Relief Bills Expected To Emerge Sunday Top Massachusetts State Senator Says With Just Hours Of Formal Lawmaking Remaining Masslive Com

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns Masslive Com

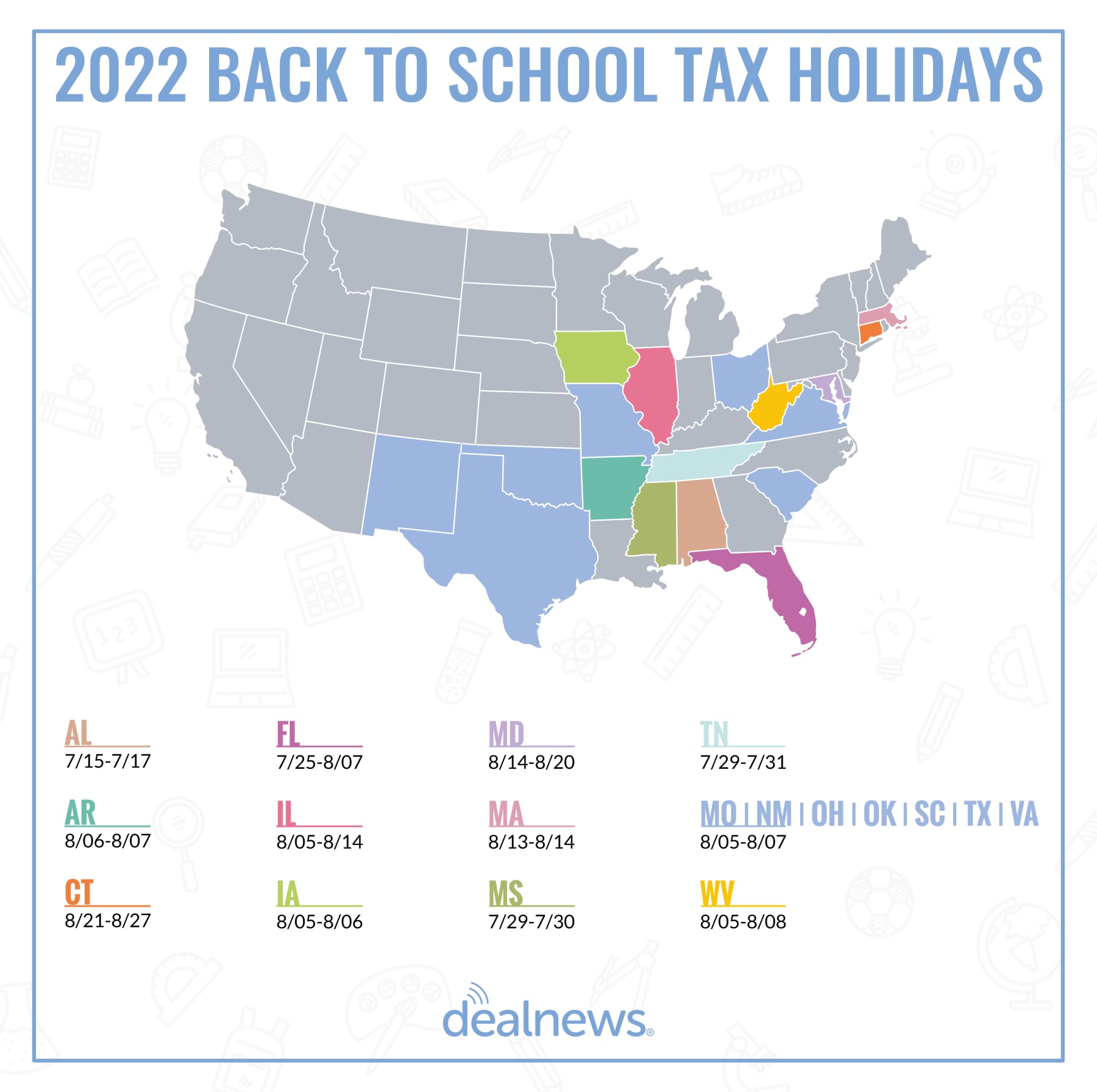

When Is Your State S Tax Free Weekend In 2022

Massachusetts Lawmaker Renews Gas Tax Suspension Push As Prices Hover At Record Highs President Joe Biden Mulls Federal Gas Tax Suspension Masslive Com

Question 1 A More Equitable Mass Or The Wrong Time For A New Tax

Exemptions From The Massachusetts Sales Tax

New England Food Show Ma Restaurant Association Mra Recovery Update For 9 15 20 Announcement Deferring Meals Tax Due On 9 20 Https Conta Cc 3mpzt4s Facebook